-

Investors and banks have the potential and the economic interest to take on a leading role in the

transformation of the automotive industry.

Investors invest where they see profitable business models with the lowest possible risks. Climate protection is gaining importance as an evaluation criterion. This applies not least to the automotive industry, whose products have so far contributed greatly to global warming. Large amounts of private capital are necessary for the transformation of the automotive industry. Therefore, capital providers who want to hedge their investments against climate risks can exert a great influence and accelerate the transformation of the automotive sector.

-

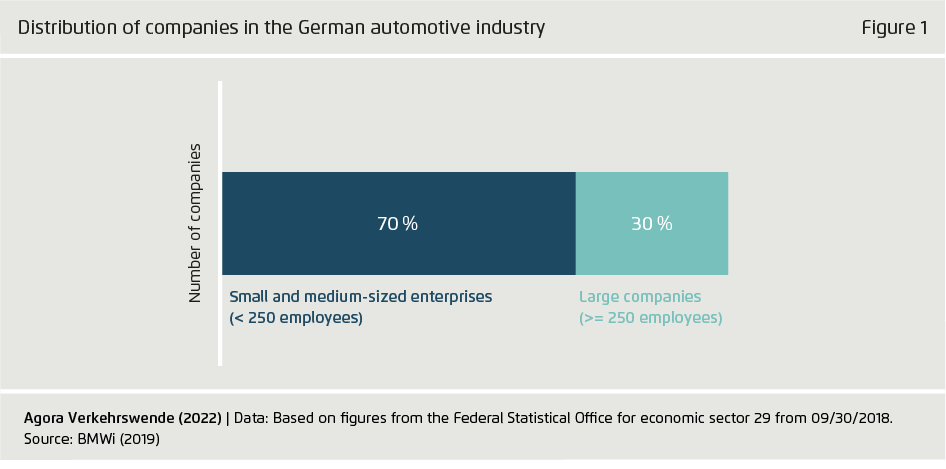

Policy lays the groundwork for investors and banks to fulfil their leadership role by requiring automotive companies to report on climate change.

The Paris Climate Agreement is increasing the pressure on politicians and financial market regulators to move markets in the direction of climate protection. One important instrument is the reporting requirements for companies. In the future, the reports will show whether a company‘s business model and strategy meet the requirements of the Paris Climate Agreement. Beyond the reporting obligation, policymakers are developing climate-oriented framework conditions to create long-term planning and investment security for all relevant actors.

-

Automotive companies report transparently on the climate orientation of their business model and thus secure their access to capital.

Climate policy requirements for automotive companies are increasing worldwide – but not at the same pace everywhere. In order to protect themselves from these regulatory risks and to remain competitive in the long term, automotive companies are aligning themselves early with the Paris Climate Agreement. They prepare their strategies and measures transparently. They combine sustainability-related and financial factors in their risk analyses. Based on this information, the capital markets can direct their investments specifically towards climate-friendly business models. Access to capital is only possible for automotive companies with transparent climate reporting.

-

Rating agencies use company reports to assess the contribution of automotive companies to

compliance with the Paris Climate Agreement now and in the future.

So far, climate-related risks have often been underestimated in credit assessment and credit ratings and excluded as „non-financial.“ In addition, company reports and ratings concentrate on the current financial year and at best compare them with previous ones. Only with an integrated assessment of the financial and sustainability factors can agencies give the capital markets a realistic picture of the potential investment risks. This also includes information on how companies will align themselves with the Paris Climate Agreement in the future.

-

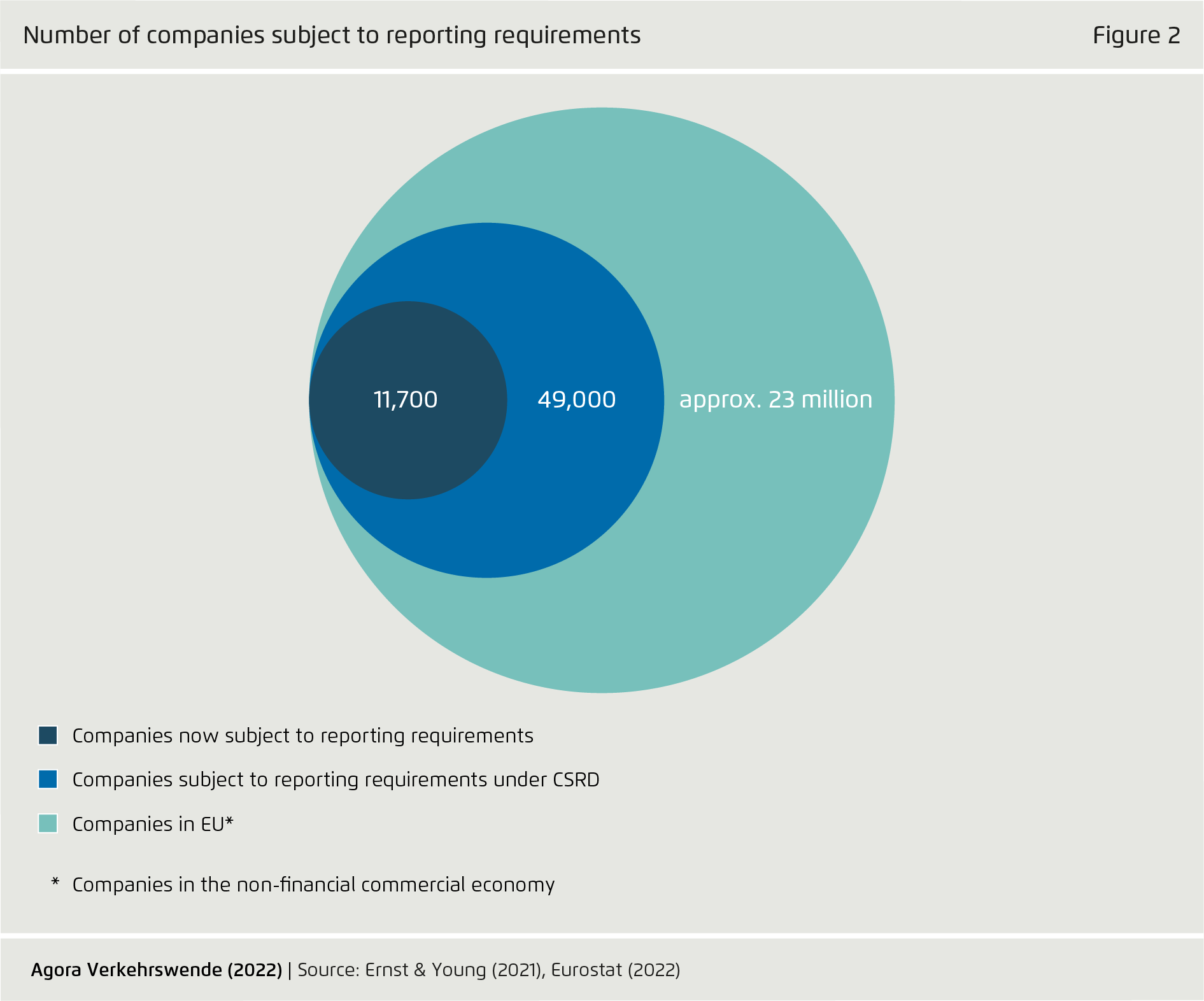

A simplified assessment procedure is being developed for small and medium-sized enterprises in the automotive sector so that they too become attractive for climate protection capital.

Currently, business valuations primarily cover large companies. Unlike large companies, small and medium-sized automotive companies often do not have the processes and structures needed for positive valuations. They also have less capacity to respond to extensive and often diverse information and reporting requirements. However, as part of the transformation, they will also have to invest a lot in climate-impacting innovations and new business models. Therefore, simplified assessment procedures are needed for small and medium-sized enterprises in the automotive sector.

This content is also available in: German

Capital for the Transformation of the Automotive Industry

How investors and banks can take a leadership role in achieving the Paris climate goals in the automotive sector

Preface

Major investments are needed to decarbonize the automotive industry. Manufacturers and suppliers are particularly dependent on investors and banks for financing. These in turn have an economic interest in hedging their investments against risks. Climate risks are increasingly playing a role in this. Climate protection-oriented investors can thus make a decisive contribution to accelerating the decarbonization of automotive companies. At the same time, only automotive companies whose business models and strategies are consistent with the goals of the Paris Climate Agreement offer investors and banks protection against climate-related risks.

So how can investors and banks take a leadership role in achieving the Paris climate goals in the automotive sector? With this discussion paper, we focus on the potential for investors and banks to take a leadership role in decarbonizing the automotive industry. On behalf of Agora Verkehrswende, the Institute for Sustainable Capital Investments (NKI) has developed initial approaches on how this can be leveraged.

Key findings

Bibliographical data

Downloads

-

pdf 983 KB

Capital for the Transformation of the Automotive Industry

How investors and banks can take a leadership role in achieving the Paris climate goals in the automotive sector

All figures in this publication

Distribution of companies in the German automotive industry

From Capital for the Transformation of the Automotive Industry on page 1

Number of companies subject to reporting requirements

From Capital for the Transformation of the Automotive Industry on page 2