-

Policymakers must realign the tax and levy system for motorised private transport to meet the enormous challenges of the coming years.

The taxes, levies, subsidies and support programmes in force in the transport sector today do not take into account the climate-, transport- and budget-related imperatives that will become increasingly salient over the course of this decade. The existing fiscal architecture largely stems from the heyday of fossil fuel energy supply, and is not headed in the direction of a climate-neutral future. The adjustments made so far at the level of individual fiscal instruments are piecemeal and insufficient. In order to make the portfolio of fiscal policy instruments fit for the necessary transformation of transport beyond the current legislative period and beyond 2030, they must be adapted to current and future requirements, coordinated with one another and supplemented in a targeted manner with future-proof and intelligent solutions. Above all, a new fiscal architecture must ensure that passenger car transport makes its contribution to achieving climate targets, that high-quality transport infrastructures and mobility services for all can be financed, and that competition for the scarce resource of public space is alleviated and road capacities are not overloaded. This must be achieved in a way that is both economically efficient and socially balanced.

-

A carefully balanced fiscal architecture takes into account instrumental interactions and anticipates the upcoming transformation.

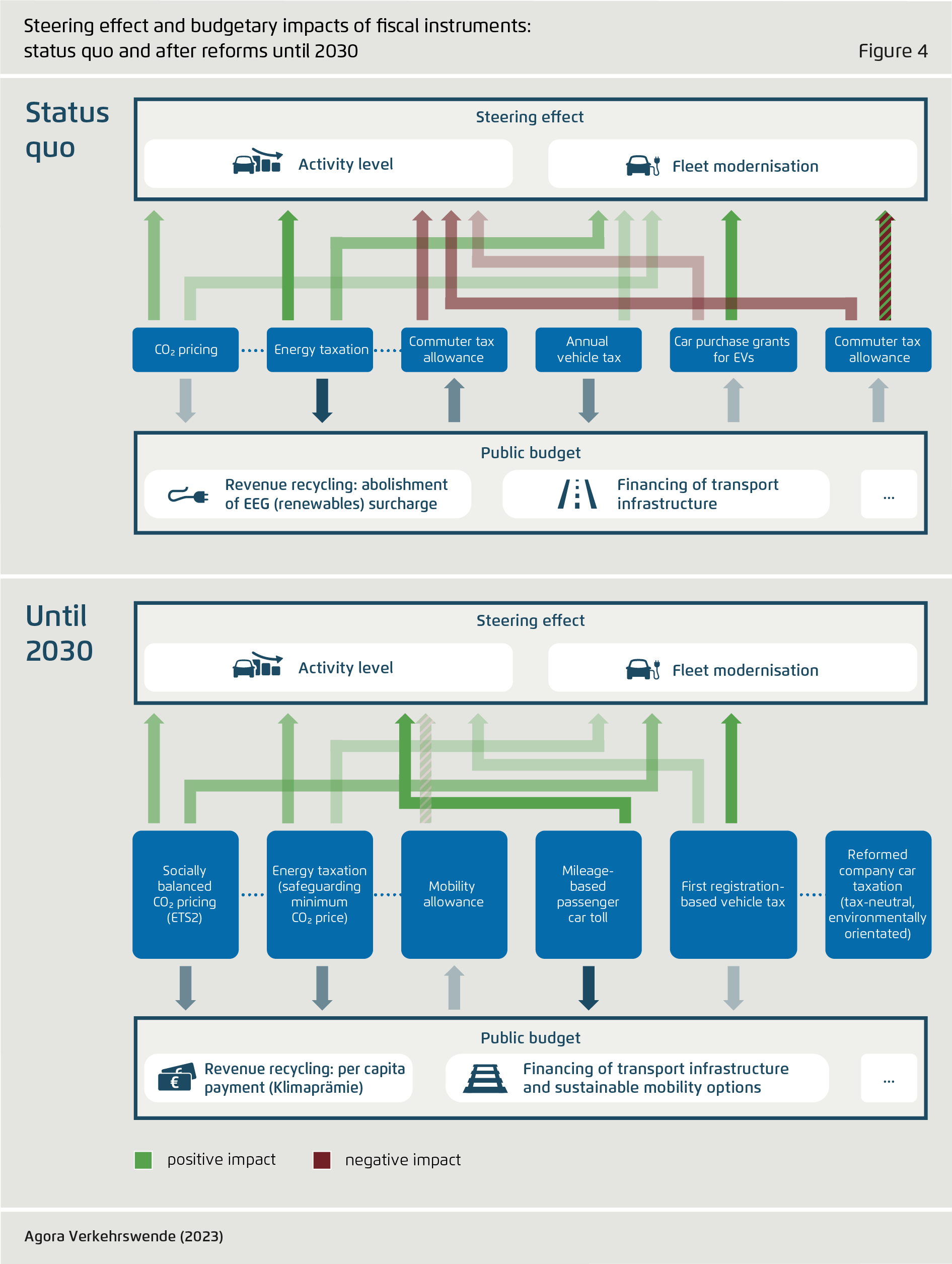

The main pillars of the fiscal architecture for reducing emissions from transport are, on the one hand, instruments that primarily address the level of activity and the choice of transport mode by changing the (relative) prices for different forms of mobility, and, on the other hand, instruments that primarily aim to influence vehicle characteristics. Some instruments address more than one lever, which is why they have to be well coordinated, and instrumental synergies and interferences have to be taken into account. Careful and regularly reviewed coordination is also necessary because the importance of the individual instruments changes in the course of the transformation process – in addition to those with steadily increasing or steadily decreasing importance in terms of climate protection and securing public revenue, other instruments may only have a temporary role.

-

National fiscal architecture complements the climate policy framework and instruments set at European level for passenger car transport.

Certain interactions with the climate policy instruments for passenger car transport at the European level also need to be considered. Of particular importance is the interplay between the European CO2 emissions standards and the fiscal incentive structure for vehicle purchase at the national level. If designed in a well-aligned and ambitious manner, the two regulatory approaches can complement each other in such a way that together they unlock the full potential for fleet transformation. In the medium term, moreover, the planned transfer of emissions trading for fuels from the national to the European level will create a pressing need for coordination.

-

In our view, the key elements of a portfolio of instruments that is effective in terms of climate protection, economically efficient, fiscally sustainable and socially balanced are as follows:

a. Raise the carbon price path for fuel emissions trading and - after its transfer to a European trading system in the medium term - ensure an appropriate minimum price via energy taxation; develop a practicable model for a per capita payment to redistribute the public revenue generated; do not raise the commuter tax allowance, instead transfer it to a more socially balanced mobility allowance. b. Immediate preparation and medium-term introduction of an intelligent, mileage-based passenger car toll as a stable financing instrument for transport infrastructure and sustainable mobility options, as well as for improved traffic control. c. Structural reform of vehicle taxation: introduction of a potent price signal based on first registration as the central policy instrument for the transformation of the vehicle fleet at the national level and to re-finance the purchase premiums for electric cars; abolition of the annual ownership tax for all passenger cars when the passenger car toll is introduced. d. Reform of subsidies for electrically powered passenger cars by making them degressive and gearing them more closely to their actual contribution to climate protection - both for plug-in hybrids and for fully electric passenger cars. e. Abolition of tax privileges and misdirected incentives regarding the private use of company cars through an environmentally differentiated increase in the taxable benefit-in-kind and consideration of private mileage, as well as supplementary special depreciation rules for fully electric company cars.

This content is also available in: German

Fair Prices in Road Transport

Guidelines for a climate-friendly, economically efficient and socially balanced reform of taxes, levies and subsidies related to passenger cars

Preface

Policymakers face major challenges in road passenger transport. Existing taxes, levies, subsidies and support programmes do not sufficiently take into account the climate-, transport- and budget-related imperatives that will become increasingly salient over the course of this decade. The existing fiscal architecture prevents the required savings on fuel consumption and sets incentives for ever more car traffic and ever more demand for roads and public space. This will lead to ever higher costs, for car drivers and for society in general.

In order to make the portfolio of fiscal policy instruments fit for the transformation of the transport sector beyond the current legislative period and beyond 2030, they must be adapted to current and future requirements, coordinated with one another and supplemented in a targeted manner with future-proof and intelligent solutions. Above all, a new fiscal architecture must ensure that passenger car transport makes its fair contribution to achieving climate targets, that high-quality transport infrastructures and mobility services for all can be financed, and that competition for the scarce resource of public space is alleviated and road capacities are not overloaded.

In this discussion paper, we outline the key elements of a fiscal reform for fair prices in road transport. These include the reform of vehicle taxation, car purchase subsidies and company car taxation, a lump-sum payment to compensate for additional burdens - financed by raising the CO2 price on fuels - and the introduction of a mileage-based passenger car toll. The paper is intended to encourage a systematic approach to the challenges ahead that creates planning and investment security for all, clearing the way for the mobility of tomorrow.

Key findings

Bibliographical data

Downloads

-

pdf 2 MB

Fair Prices in Road Transport

Guidelines for a climate-friendly, economically efficient and socially balanced reform of taxes, levies and subsidies related to passenger cars

All figures in this publication

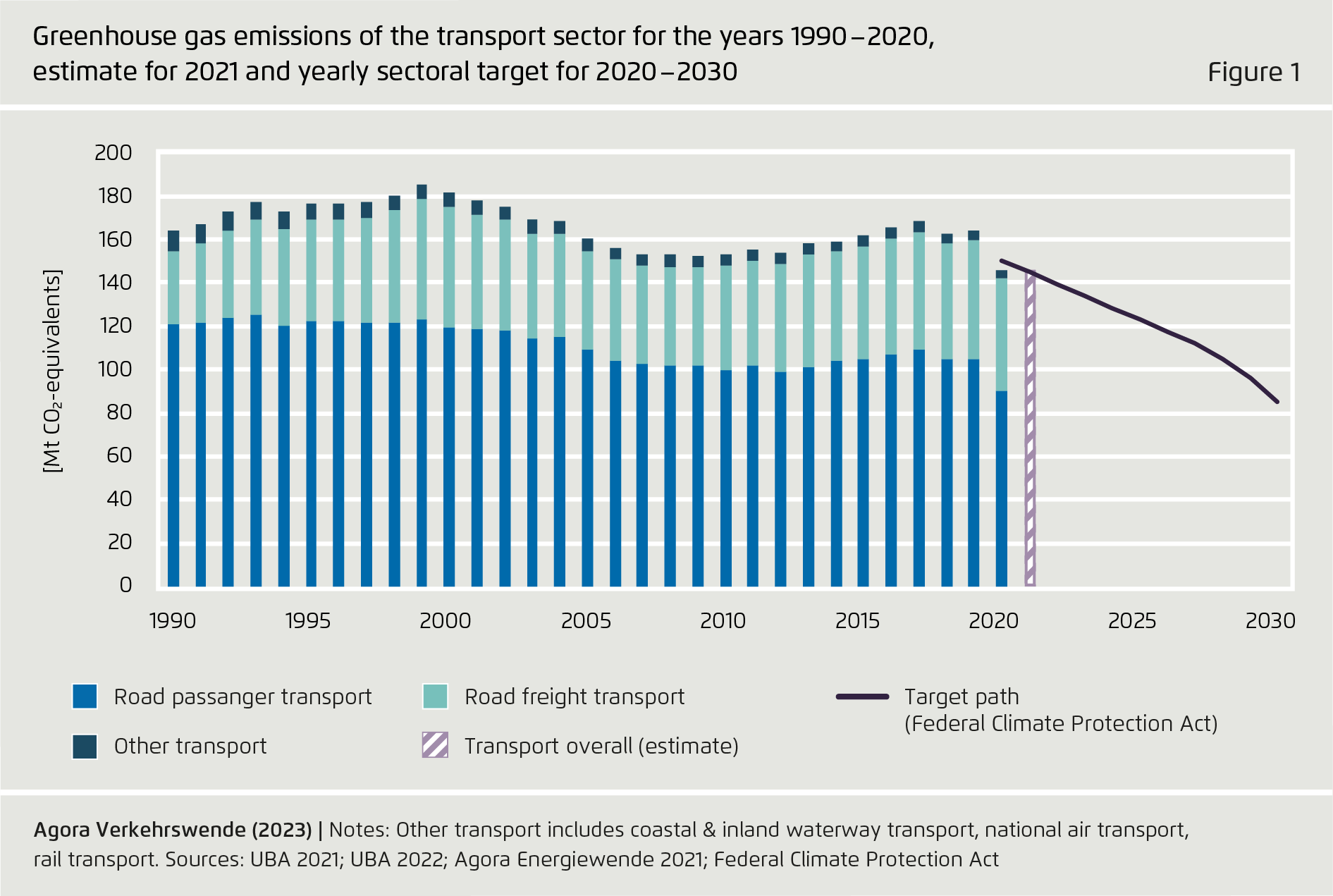

Greenhouse gas emissions of the transport sector for the years 1990–2020, estimate for 2021 and yearly sectoral target for 2020–2030

From Fair Prices in Road Transport on page 1

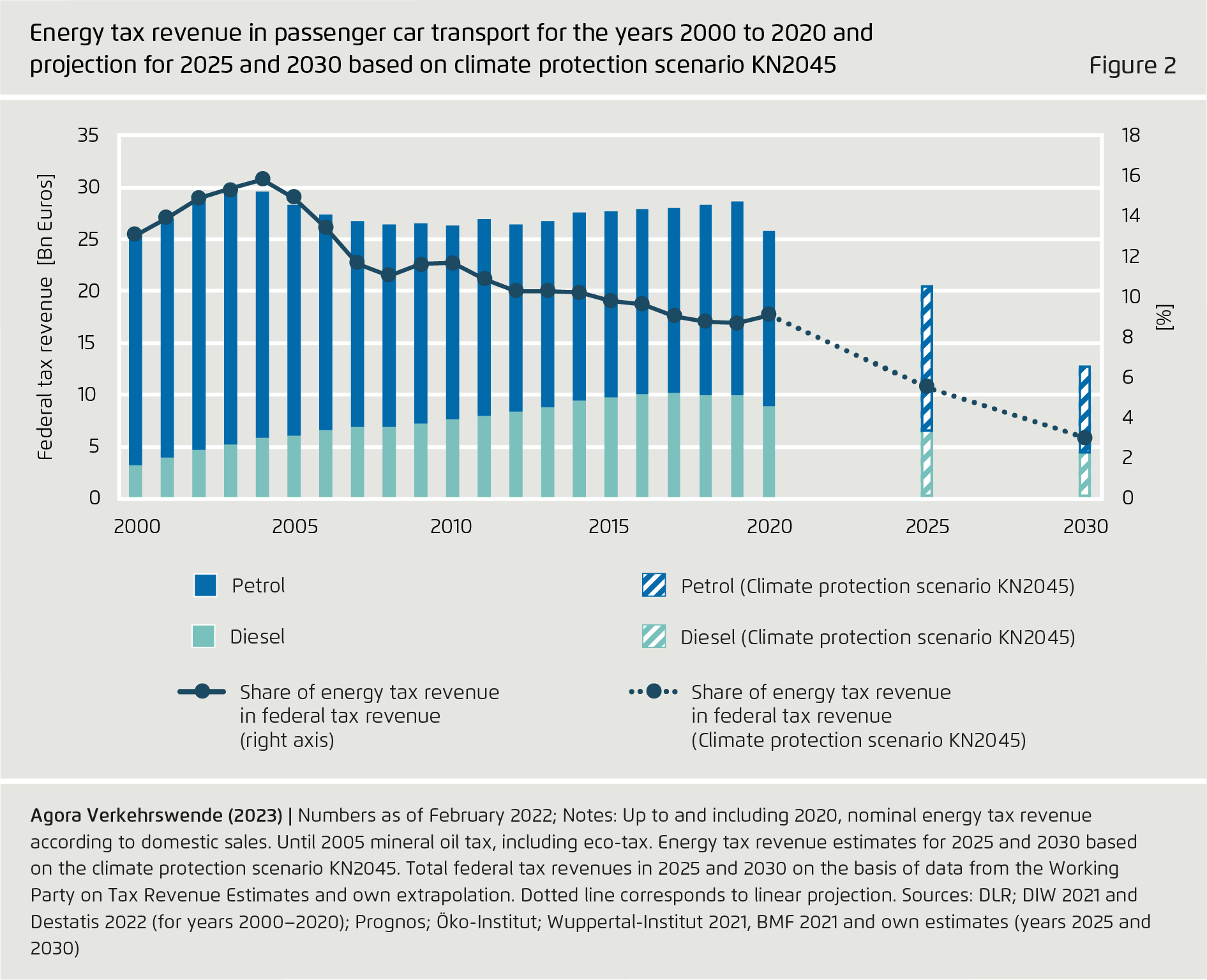

Energy tax revenue in passenger car transport for the years 2000 to 2020 and projection for 2025 and 2030 based on climate protection scenario KN2045

From Fair Prices in Road Transport on page 2